We’ve seen increased government spending due to the COVID-19 pandemic and will likely see more in the near future. This could mean a much larger tax bill later on. There are many long-term tax minimization strategies that you should consider: Capital Gains Tax Planning, Roth IRAs, and the Tax-Free Nature of Life Insurance.

Capital Gains

Regardless of your income, Long-Term Capital Gains (LTCG) tax rates are almost always going to be preferable to ordinary income tax rates.

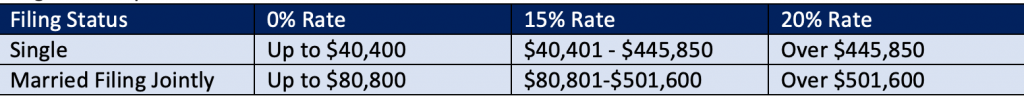

Long-Term Capital Gains Tax Rates for 2021

For example, when you are in a 10% or 12% ordinary income tax bracket, your long-term capital gains tax rate is 0%. If you are in a 22% tax bracket, the LTCG tax rate is 15%. In the 24% and 32% tax brackets, LTCG taxes will be either 15% or 18.8%*. Up over the 37% tax bracket, your LTCG tax is 23.8%*. This is a substantial difference across the board. This presents tremendous opportunities for Long-Term Capital Gains Tax Harvesting.

One huge gift the IRS gives us is that if you pass away holding a stock or piece of property that would have had a LTCG tax if you sold it, your heirs will not have to pay tax on that gain realized while you held it. Your heirs will only pay LTCG taxes on any amount gained after your death. For example, if you purchased a piece of property for $100,000 and held it for five years, and then sold it for $200,000, you would owe taxes on the $100,000 LTCG. If you passed away before selling it, your heirs would only owe LTCG on any gains over $200,000, the value of the property when you passed away.

There has been a lot of discussion in Washington about changing how Long-Term Capital Gains are taxed. They have talked about eliminating the Long-Term Capital Gains rate for people that make over $1million. There has also been talk of eliminating the step-up in basis that heirs benefit from when inheriting stock, property or other items that would receive LTCG treatment.

Roth IRA

Sometimes Roth IRAs are oversold because of the fear of future taxes. Yes, it is a reality that income taxes are going to be higher in the future with the expiration of the Tax Cuts and Jobs Act in 2026. However, many retirees will have much lower taxable income in retirement compared to their working years. Converting pre-tax retirement accounts to Roth needs to be carefully considered.

A Roth IRA makes a lot of sense when your income tax rate when you take the money out is higher than it was when you put the money in. Used effectively, Roth IRAs are extremely powerful. But, it needs careful analysis. There is an upfront tax hit when you convert an IRA to a Roth.

Here are some additional considerations for Roth IRAs:

- You can access the benefits of a Roth IRA even if you’re over the income limits.

- If your company has a Roth 401(k), workers under age 50 can contribute up to $19,500, and workers 50 and older can contribute up to $26,000.

- You have the option to convert funds from a traditional IRA, 401(k), or similar qualified retirement account into a Roth IRA no matter your income. In this case, you would pay tax on the funds converted and then be able to withdraw them tax-free later on, subject to IRS rules.

- A working spouse may be able to contribute to a Roth IRA on behalf of their non-working spouse if they file taxes jointly, also called a spousal Roth IRA.

- There are contribution limitations to Roth IRAs. Single filers with a modified adjusted gross income (MAGI) of over $140,000 and married couples with a MAGI of over $208,000 don’t qualify to contribute to a Roth IRA. However, there are alternative ways to take advantage of the benefits of a Roth IRA.

Tax-Free Nature of Life Insurance

Life Insurance can be a tremendous estate transfer tool. Life insurance is income tax free and can become estate tax free if you structure it where you don’t own it. Typically, this involves an irrevocable trust.

With increased government spending and potential changes to tax structure, now is the time to review your retirement plan, especially if you have a substantial amount saved in a tax-deferred retirement account. It’s important to have an up-to-date tax minimization strategy to help you reduce your tax burden on a year-to-year basis and in the long-term.